Depreciation recapture calculator rental property

The experts at Equity Advantage will ensure yours does. I inherited a rental property that was being depreciated.

8 Powerful Real Estate Investment Calculators A Full Review

They were being depreciated with a useful life for.

. I believe I must start depreciating the property itself for 275 years SL using the net FMV of the building at the date I inherited it as the basis. By convention most US. Capital gains tax rate of 0 15 or 20 depending on filing status and taxable income.

Recall that the annual depreciation deduction on the rental property was 5218 per year. Does all the depreciation now work back in her 2016 tax return to pay more tax. Depreciation recapture tax rate of 25.

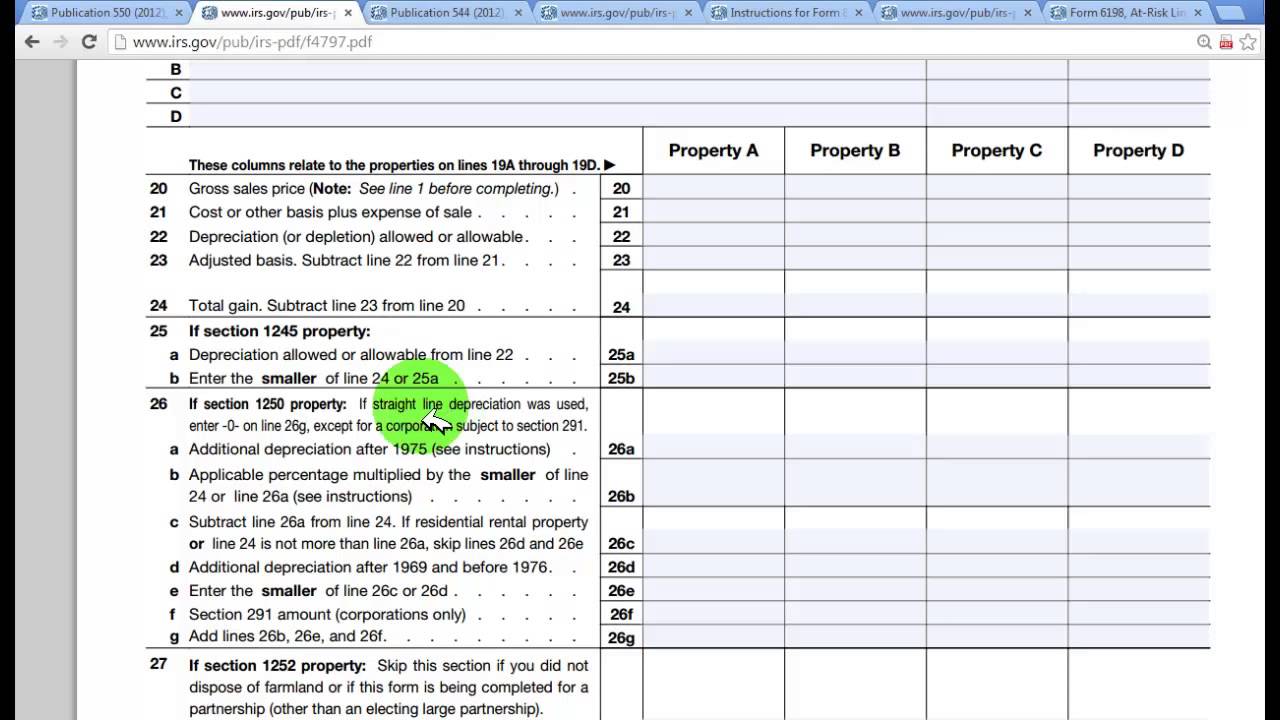

If you dispose of property depreciated under ACRS that is section 1245 recovery property you will generally recognize gain or loss. Gain recognized on a disposition is ordinary income to the extent of prior depreciation deductions taken. Great for rental depreciation.

My mother also claimed depreciation on the rental property during the years under her ownership. This recapture rule applies to all personal property in the 3-year 5-year and 10. Simplify reporting your rental property depreciation and get the biggest tax deduction.

Depreciation commences as soon as the property is placed in service or available to use as a rental. If you sell rental or investment property you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of investment within 180 days. That 709 form is not too hard to do by hand in this case.

Form 4835 Farm Rental Income and Expenses. When you sell a rental property you need to pay tax on the profit or gain that you realize. Importantly you only pay depreciation recapture tax on the amount that you have claimed while owning the property.

Guidance and support for employee stock plans. Assuming seller closing costs run 8 of the sales price including the real estate commission deductible closing costs on the rental property sold for 164000 would be 13120 leaving you with a net sales price of 150880. However fill in lines 23a through 26.

Taxes rental property investors need to pay. Be sure to enter the number of fair rental and personal-use days on line 2. So part of the gain beyond the original cost basis would be taxed as a capital gain but the part that relates to depreciation is taxed at the 1250 rule rate.

Real estate economics is the application of economic techniques to real estate marketsIt tries to describe explain and predict patterns of prices supply and demandThe closely related field of housing economics is narrower in scope concentrating on residential real estate markets while the research on real estate trends focuses on the business and structural changes affecting. List your total income expenses and depreciation for each rental property. To determine the amount youll be taxed on your depreciation recapture use our depreciation recapture tax calculator.

Depreciation recapture in the USA is governed by sections 1245 and 1250 of the Internal Revenue Code IRC. This is known as depreciation recapture which is specific to rental properties and the amount previously taken as a depreciation deduction is taxed at a recapture rate of 25. But what about the other assets.

This rule states that the depreciation recapture on real estate property is not taxed as ordinary income as long as a straight line depreciation was used over the life of the property. Form 4797 Sales of Business Property. So if youve claimed 40000 in depreciation during the course of your ownership and you are taxed at the maximum depreciation recapture tax rate 25 you would pay 100000 in total when the rental property is sold.

Residential rental property is depreciated at a rate of 3636 each. Depreciation recapture a provision the IRS uses to tax the profitable sale of a rental property on which the owner has previously claimed depreciation can have a great impact on an investors bottom line. Use our calculator to estimate tax liability should a transaction not qualify as a 1031 exchange.

Depreciation recapture most commonly applies when dealing with the sale of improved real estate such as rental property as the value of real estate generally increases over time while the improvements are subject to depreciation. Does my mother have to pay tax on the 80K profitcapital gain 180-100K. It and its new floor coverings and appliances have been depreciated for 2 tax years.

If you have more than three rental or royalty properties complete and attach as many Schedules E as are needed to separately list all of the properties. Form 4255 Recapture of Investment Credit. The IRS taxes the profit you made selling your rental property 2 different ways.

Tax Rate On Real Estate Capital Gains Tax Impacts On The Disposition Of A Rental Property Held By An Individual

Form 4562 Rental Property Depreciation And Amortization

Tax Benefits Of Accelerated Depreciation On Rental Property

Depreciation Recapture What It Is How To Avoid It In 2022 Capital Gains Tax Irs Taxes Savings Strategy

Capital Gains Recapture On Disposition Of A Rental Property Youtube

Understanding Rental Property Depreciation 2022 Bungalow

Rental Property Depreciation Rules Schedule Recapture

Tax Treatment Of Sale Of Rental Property Youtube

Depreciation Recapture What It Is How To Avoid It In 2022 Capital Gains Tax Irs Taxes Savings Strategy

Rental Property Depreciation Rules Schedule Recapture

Tax Rate On Real Estate Capital Gains Tax Impacts On The Disposition Of A Rental Property Held By An Individual

How Do You Calculate Return On Investment On Rental Property

How To Depreciate A Rental Property Formula Excel Example Zilculator Real Estate Analysis Marketing

Depreciation Recapture What It Is How To Avoid It In 2022 Capital Gains Tax Irs Taxes Savings Strategy

How To Use Rental Property Depreciation To Your Advantage

Should You Sell Or Rent Your Home Before A Military Move Military Move Buying First Home Moving

How Does Rental Property Depreciation Work Biggerpockets